When you invest sustainably, you invest in the future

The recent report from the UN’s Intergovernmental Panel on Climate Change (IPCC) has alarmed many of us and with good reason. The report paints a bleak picture of the future of our planet if we do not take immediate action. Meanwhile, extreme weather events have been getting more frequent while unprecedented wildfires are burning across the Northern Hemisphere. Governments have failed to take the actions necessary to stop climate change, despite the increasing urgency. It is understandable that many people feel scared about the future and helpless to do anything about it.

But YOU are not helpless. There is a lot you can do in your personal life – as a human being – and as a citizen, a member of society. Just as important, you can channel your savings toward the fight against climate change and other key environmental and social issues of our time by investing sustainably.

Getting the Terms Straight

There is a lot of confusion over what “sustainable investing” actually means, so it makes sense to start out with some clarifications.

Just what is “sustainable” anyway? We’ll use the definition of the UN’s Brundtland Commission back in the 1990s: “Sustainability is meeting the needs of the present without compromising the ability of future generations to meet their own needs.”

The trend toward considering more than purely financial factors in investing began way back in 1971 with the opposition to the Vietnam War. It gathered steam in the 1980s with the movement to divest from South Africa. This was the beginning of what became known as Responsible Investing, as investors started asking for exclusions beyond just apartheid.

Funds that are invested “responsibly” avoid certain sectors widely considered harmful to society, such as weapons, tobacco, gambling, alcohol, etc. Other than these exclusions, such funds are invested much like any other.

Responsible investing allows investors to have a clean conscience because their money is not financing economic activities that they oppose, but it ignores the vast majority of companies that don’t engage in these activities.

This is where Environmental, Social and Governance (ESG) Investing comes in. Investors applying ESG criteria are not simply excluding certain sectors. They are looking at all potential investments to assess how companies are managing their environmental impact (E), their treatment of employees, customers, and the communities in which they do business (S), and their responsiveness to shareholders (G).

The aim is to ensure that financing goes primarily to companies that adhere to high standards of conduct on these key issues and not to those that do not. In many cases, both Responsible Investing and ESG Investing lend themselves to computer-driven passive management such as index funds.

Sustainable Investing is the next level, going beyond screening out companies that do not meet ESG standards to actively seek out companies that are leaders on these issues (“screening in”). Sustainable investors are channeling capital to investments that further their environmental and social goals and seeking to generate superior investment returns by doing so. To invest sustainably, more active management is required: A computer cannot easily seek out companies that are leaders in moving toward a more sustainable world.

Impact Investing takes investing sustainably a step further. Impact investors seek to drive change by focusing on an issue or issues that are particularly important to them and directing their investments to a few key projects, companies or organizations.

This results in a concentrated portfolio of investments that are not readily tradeable and that often require hands-on engagement. For these reasons it is not always suitable for sustainability-minded individual investors who are just trying to beat the market while ensuring that their investments are aligned with their values. This is why endowments and foundations have generally taken the lead in this area.

Another difference with sustainable investing is that impact investors are often willing to sacrifice not just liquidity, but also some performance, in order to meet their environmental or social goals.

Yes, You Can Make Money in Sustainable Investing.

“But can I make money investing sustainably?” This is a natural question. It is widely accepted in our society that doing the right thing entails making sacrifices.

More concretely, finance theory teaches that narrowing the range of available investments by excluding sectors or companies for whatever reason hurts investment performance by reducing the ability to diversify. An undiversified portfolio is exposed to more concentrated risks and suffers from a narrower range of investment opportunities. Most investors, therefore, assume that to invest sustainably will make them less money than conventional investing.

Investing sustainably means taking into account a wide range of environmental, social and governance issues alongside more traditional financial factors. In the long-term, including these additional factors in the investment process may in fact lead to better performance, despite excluding certain sectors or companies.

Companies that manage their businesses with a close eye on the context in which they operate and on the long-term consequences of their business practices are likely to deliver better performance with fewer risks. Investing sustainably helps investors avoid companies that produce unpleasant surprises such as the BP disaster in the Gulf of Mexico, the rash of employee suicides at the factories of Apple supplier Foxconn or the accounting fraud that brought down Enron.

It has paid to stay out of fossil fuels.

One of the sectors most likely to be excluded from sustainable portfolios is, of course, fossil fuels. This sector includes some of the biggest companies in the US. Not owning them would seem to be a risky position to take and certainly it hurts the relative performance of sustainable investment strategies when oil prices rise. Yet by the end of 2020, fossil fuel stocks had consistently done worse than the market every single year for ten years running. Over the same time period, investors in renewable energy companies made seven times as much money as investors in fossil fuels.

As noted in a recent Bloomberg article, the global renewable energy sector posted an annualized return of 18.0% over the ten-year period. Meanwhile, investors in global fossil fuel companies made only 4.7% annually, well below the 9.9% returns earned by global stock markets as a whole. Thanks to this long-term underperformance, fossil fuel stocks made up a mere 2.8% of the S&P 500 index as of June 30.

At Fidelity, a screened US market index fund has consistently beaten an unscreened one.

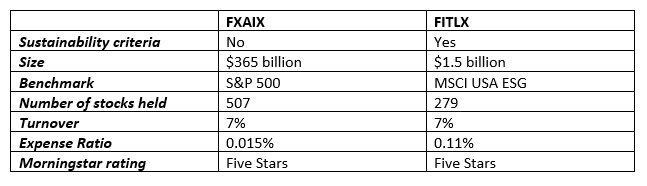

For a broader look at the question of whether investing sustainably hurts returns it makes sense to compare two similar index funds managed by Fidelity: The Fidelity 500 Index Fund (FXAIX), and the Fidelity US Sustainability Index Fund (FITLX).

Both of these funds aim to replicate the performance of an index of the biggest US companies. FXAIX follows the well-known S&P 500 while FITLX follows the MSCI USA ESG Index. FXAIX does not have any sustainability criteria. The MSCI USA ESG Index includes only US large and mid-sized companies that have high ESG ratings relative to their peers. In other respects, the funds are quite similar. In fact, five of the funds’ top ten holdings are the same.

Two similar index funds:

As of August 31, 2021. Sources: Fidelity, White Pine Advisory.

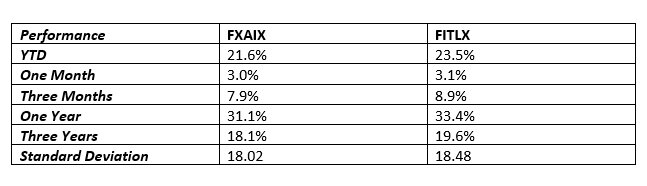

Contrary to what might have been expected, the better performer of the two funds is the sustainable one:

As of August 31, 2021. Performance numbers over one year are annualized. Sources: Fidelity, White Pine Advisory.

Despite having a sustainable orientation that excludes several important sectors of the economy and narrows the range of investment opportunities available to it, the Fidelity US Sustainability Index Fund has consistently outperformed its conventional peer over every time period measured in the last three years. Importantly, the Sustainability Index fund achieved this higher performance while also delivering slightly less volatility than its conventional peer, as measured by standard deviation.

A key caveat is that this outperformance is over a relatively short time period since the Fidelity US Sustainability Index Fund was only launched in May 2017.

So YES, you can make money when you invest sustainably. The assumption that sustainable investing necessarily leads to lower returns is simply wrong. In fact, you may even do better.

Beware of “Greenwashing”

With climate change on everyone’s mind, sustainability is the hot new trend in investing. According to Bloomberg, $118 billion has flowed into ESG exchanged traded funds over the twelve months to June 30, 2021, and at the end of the first quarter, almost $2 trillion was invested in more than 4,500 sustainable funds globally.

Naturally, many in the financial industry are rushing to take advantage of this. The handful of smaller firms that have been specializing in sustainable investing for years have suddenly found themselves competing with giant mainstream firms that used to consider sustainability a niche issue.

All kinds of investment products are having “ESG” and “sustainable” labels slapped on them. As noted in the Bloomberg article mentioned above, definitions differ not just between countries but between investment products and the quality of reporting on sustainability issues varies widely from one company to another. Another recent Bloomberg article reported that Europe’s fund management industry had to remove the ESG label from an estimated $2 trillion in assets between 2018 and 2020 as the EU began to implement tougher regulations.

The SEC released a Risk Alert on April 9th revealing that some fund managers are promoting their funds as ESG investment products when they are not, highlighting that some firms lack formal procedures to ensure that investments billed as “ESG” are in fact meeting these standards. The SEC signaled that some firms mischaracterizing their investment products in this way could be violating securities laws. In the business, we call this “Greenwashing.”

Here at White Pine Advisory, we uncovered what appeared to be an example of sloppy labeling when investigating a potential investment for an endowment that seeks to keep its portfolio fossil fuel free.

We were considering buying Black Rock’s iShares ESG Aware Emerging Markets ETF but noticed that it had a higher-than-expected carbon intensity. On further investigation, we discovered that the fund held both Saudi Aramco and Russia’s Gazprom. Not only are both of these among the biggest fossil fuel companies in the world, they are also majority government-owned, which poses risks for other shareholders. Saudi Aramco has serious disclosure issues. Gazprom is well known for aligning itself with the Russian government - sometimes at the expense of other investors - and for its problematic track record on safety and the environment.

We reached out to Black Rock for an explanation. They were very responsive and helpful and explained that the ETF excludes coal and oil sands but not fossil fuels in general. Additionally, they do not actually take corporate governance issues into account and so do not exclude companies that mistreat minority shareholders.

It seems that “ESG Aware” in this case means “some limitations on energy investments, some sectors (such as guns) not allowed on social grounds and no awareness of governance issues.” Unfortunately, this made the ETF uninvestable for our clients.

Sometimes Greenwashing is intentional, sometimes it is just sloppiness or a difference in definitions. In the case of clean energy funds – which Morningstar recently found to be significantly more carbon-intensive than the market as a whole – the issue is that some of the worst offenders are also the ones leading the push for improvement. Investors who truly want to invest sustainably should be prepared to do some digging or entrust their investments to a professional with sustainability expertise.

What are you waiting for?

Sustainability is no longer a niche issue for investors and renewable energy stocks have dramatically outperformed but that does not mean that you have missed the boat. As sustainable investing becomes mainstream companies, will inevitably be subjected to a higher degree of scrutiny, which should lead to continued outperformance by those that adhere to higher ESG standards.

As for renewable energy, the sector is going to need to invest hundreds of billions of dollars to build capacity to replace the demand currently being met by fossil fuels. Public policy will increasingly favor the sector in order to meet zero-emission targets and technological advances will continue. The sector’s outperformance is far from over.

On both a financial and an ethical level it is never too late to ensure that your investments are aligned with your values and with a sustainable future for our world. It’s time to do your part. What are you waiting for?

Urban Larson

Principal

Disclosure

White Pine Advisory LLC (“White Pine”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where White Pine and its representatives are properly licensed or exempt from licensure.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Past performance shown is not indicative of future results, which could differ substantially.